The headlines in the news and media are SCARY right now. If I wasn’t a professional with financial experience in mortgages, I would be fearful.

Take this headline.

‘Bank of Canada says some Canadians could see mortgage payments jump by 45% in 2025-26 rate rises.’

How many of you had an anxious reaction to is? Then the headline has done its job.

The media’s job is to create a reaction of fear and doubt where you question yourself. Are you in the right product or rate and that you can’t afford your home?

We have been living in real fearful world these past few years and headlines like this create more fear and anxiety.

But my job as a professional mortgage broker is to help reduce that fear and uncertainty.

Where We’re At

I totally understand costs are rising. Inflation is real.

We have been in an environment of extremely low interest rates for 2 years. Even before Covid, rates were low. Now prime rates are increasing to pre-Covid times, and the media has spun it to appear that it is higher than normal—that things are out of control.

Fixed rates have increased to the high 4% to 5% range. Prior to Covid, banks posted rates were in the 4-5% range.

My first mortgage had a rate of 6% in 2004.

Most homeowners in the past 12 years haven’t experienced these normal rates. They have been in a rate environment with rates under 3% that are not sustainable rates.

There are supply issues that are causing inflation. Our economy is adjusting to all the changes.

The economy also goes in cycles. What goes up, must go down.

We are in an increasing rate cycle.

We are also headed for a recession in the next 12-24 months. But, during recession times, rates fall.

What’s Going To Happen With My Mortgage?

Is it possible for some Canadians see their payments rise by 45% in 2025-26. Yes.

That’s because rates were low starting at 1.45%. That isn’t normal.

Rates could be in the range starting at 3% or even 4% in 3-4 years. That is the more normal range than being in low 2%.

The stress test that was rolled out in 2016 have borrowers qualifying at higher rates than what they are getting. For the past year, borrowers were qualified at 5.25% or higher to ensure they could afford mortgage if rates increased.

If you are in a variable rate mortgage, your payment will adjust to prime. Historically those in variable rates have greater savings. They do increase but they also have come down.

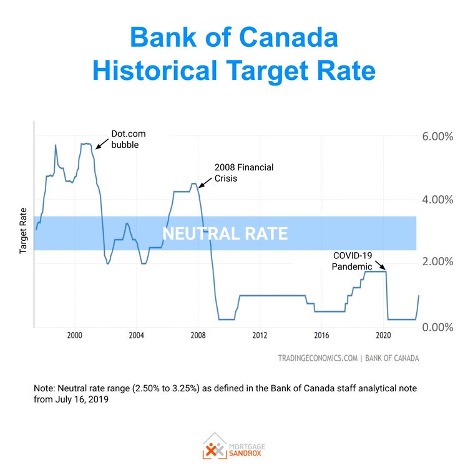

Below is the historical trend of prime. It shows times when they increase, and they show times when they decrease especially during times of recessions.

Here’s what I do know:

- Clients that were in variable rates in 2017, experienced prime hike of 1.25% in an 18-month period. March 2020, when restrictions hit, prime dropped 1.5%, and the stock market was tumbling. People were panicking with job losses and what was going to happen. It was unprecedent times. Those in variable rates experienced a drop in their payment and increased interest savings. If they had to break their mortgage, it was based on 3-month simple interest. Prime currently has only increased 1.25% from the initial drop. We aren’t at pre-Covid rates yet for prime

- In 2018-2019, fixed rates were around 3.94% and majority locked in then. When March 2020 hit, fixed rates and variable rates dropped significantly. Clients wanted to take advantage of these rates but couldn’t because the prepayment penalty was too high. Meaning, some clients were faced with $40,000 prepayment penalty for a $400,000 mortgage. If they had to sell, they lost a lot, if not all their equity to penalties. There were a lot of upset borrowers that couldn’t lock into lower rates that were being offered.

- Borrowers that were already in variable rates, we were often able to redo their mortgage into even lower rates or experienced much lower prepayment penalties if they did have to sell their home

When the stock markets are headed downward fast, a good financial planner won’t tell you to pull your investments when things hit a low. A good financial planner will tell you to ride it out.

A professional financial planner tries to time the market to maximize your investments. Reacting out of emotion over logic can cause poor decision making.

I have spoken with financial planners this past year. Their clients that panicked and pulled out when the market dropped and lost a good chunk of their investments. But, those that rode it out, experienced growth when the market went back up.

A professional mortgage broker tries to do the same. We look at more than just a rate. We look at how to save interest over the long term, how to maximize cash flow or to pay lower debts. It is more than just rate.

How I’m Feeling

I feel anxious too.

Am I worried about the increase in my own personal mortgage rate? No.

We are in a cycle right now. We need to look at what we can control. We adapt.

I witnessed several clients have income cut in half when oil prices dropped in 2014 and again in 2020. People adapted. That’s life in a changing environment.

I have personally experienced challenging times.

I know the stress. I once had a young family on a very tight budget. I was also a single mom of 3 young children with no guaranteed income and a mortgage. I know the stress all too well. It is a conscious effort to focus on the positive in life and be adaptable.

Mortgages and finances are a big concern for people. I do my best to run the numbers to help calm the emotions when increases happen.

Myself, like many other professional mortgage brokers do our honest best to put you in the right product and rate at that economic time.

There is no perfect timing. However, an experience broker knows more than a headline that the media publishes. We know that creates a reaction. So, trust you are working with an experienced professional who is looking beyond that headline.

I’m here to support your financial, and personal, well-being. If you are still worried about rates and where we’re going, please reach out. Let’s work together to find a solution that makes you feel confident in your finances.