When I work with clients on their mortgage pre-approvals, there’s one key component I like to stress.

Buying at the top end of your pre-approval budget could be setting you up for tighter expenses and stress down the road.

Being pre-approved for a certain amount gives you an idea of your borrowing capacity. It doesn’t necessarily mean that you should spend that much.

Why?

Because your overall home cost is more than just a mortgage payment.

Things to Consider for your Housing Budget

- Affordability: Part of our pre-approval budget determines whether the monthly mortgage payments, including interest, taxes, and insurance, align with your overall budget. Buying at the top end of your pre-approval limit may strain your current finances and leave you with little room for unexpected expenses.

- Future Financial Goals: We have to consider your long-term financial goals. If you have other financial commitments or plans, such as saving for retirement, education, or starting a business, stretching your budget to the maximum may impede your ability to pursue those goals.

- Maintenance and Other Costs: Owning a home involves additional expenses beyond the mortgage payment, such as property taxes, homeowners insurance, maintenance, repairs, and utilities. A larger property is going to cost more and we need to make sure those expenses don’t stretch your current finances.

- Lifestyle Changes: If you plan to start a family, you may need to account for childcare expenses or a reduction in income during parental leave. I know it’s difficult to predict the future and where we want to go but you want to have the financial flexibility when your lifestyle does change.

- Market Fluctuations: We all know what it was like during COVID and now the recent years of increasing interest rates. Buying at the top end of your budget can make you more vulnerable to market fluctuations, making it difficult to sell or refinance your property if needed.

The Housing Expense Pie

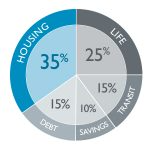

Budgeting is really a piece of cake, or a pie in this circumstance. The following pie chart shows how your entire set of financial responsibilities can be broken down into five areas.

Housing – 35%

This section contains any monetary contributions you make to your home. This can include your mortgage, property tax, water, electricity bills, equipment rentals or maintenance. If these add up to 35% of your total income, you’re on the right track. If not you might have to sacrifice in other categories such as vacation, debt repayment or savings.

Debt – 15%

Your auto and home debts are not included in this section as they are fixed expenses. This slice of the pie includes debt incurred on credit cards, lines of credit and student loans.

No debt? No problem! Spread your 15% throughout your other four sections.

Savings – 10%

What would you do if you lost your job tomorrow? Not sure? This is why 10% of your income should be going to your savings. In today’s economy, it’s important to keep yourself protected should the worst happen.

Life – 25%

The final slice of the pie is all about you. Your food, entertainment, medical expenses, technology, vacations and really anything that doesn’t fall into the other four categories falls here.

What I would recommend here is that before you start cutting costs from your Lifestyle budget, reach out to your financial advisor or mortgage broker, to see if there’s a way to decrease your overall debt expenses.

You might be surprised by the simple ways you can reduce your debt expenses just by starting the conversation!

Happy They Didn’t Buy at The Top of Their Pre-Approval Budget

I’ll end with a story from a recent conversation I had with a homeowner.

“I wanted to buy a bigger home which, at the time, we could have afforded with our pre-approval budget. However, my husband didn’t want to spend that much. We settled for something about $25,000 lower than the top of our budget. I’m honestly so happy we made that decision!

Both of us moved to self-employment a couple years after we bought our home, then COVID happened, we had some large expenses for the house (like a new furnace), and with recent inflation, we’re still able to afford everything we need. I’m not sure we would have been able to if we had bought a bigger house!”

I want all my clients to be life rich, not house poor, and that starts with finding the right house (and mortgage!) to fit your needs. Give me a call if you have any questions about your mortgage budget or how to reduce your current housing expenses.